How MSC became the world’s largest container shipping company — and what it means for global emissions

Starting with Captain Gianluigi Aponte’s purchase of a single cargo ship in 1970 — the MV Patricia — more than half a century of “seemingly inexhaustible expansion” has today landed MSC (Mediterranean Shipping Company) in the world’s #1 spot of largest container shipping companies (overtaking longtime leader Maersk in early 2022).

Along the way, MSC has expanded not just its shipping container fleet, but also branched into cruise ships, ferry services, port terminal infrastructure, and multimodal logistics (including road and rail). The Swiss-based company’s oceangoing fleet now totals some 850 vessels and its operations span 155 countries, while remaining privately owned and family-run. It has also earned accolades for sustainability, although the group’s sheer size means it’s also a consequential source of shipping-related emissions.

A quick history of MSC’s ascent to #1

Following Aponte’s initial ship purchase, the nascent MSC began to grow. Fast. By the 1980s, its fleet had grown to 20 cargo ships, which Aponte soon sold to move into container shipping.

Aponte’s shipping mentor was controversial Italian businessman and politician Achille Lauro, once dubbed the “Neapolitan Onassis.” At his peak, Lauro controlled the largest private shipping fleet in the Mediterranean. Aponte and MSC diversified into cruise lines by buying Lauro's cruise fleet in 1989. Meanwhile, Diego Aponte, Gianluigi’s son, joined the family business and today is president of MSC Group. The younger Aponte is responsible for identifying the opportunity for MSC to invest in terminal infrastructure, creating Terminal Investment Limited S.A. (TIL) in 2000, which has become one of the largest terminal operators in the world.

In 2015, another growth chapter began when MSC and AP Moller-Maersk formed a vessel sharing agreement on the Asia-Europe, trans-Pacific, and trans-Atlantic trades, enabling economies of scale and efficiencies on costs, fuel usage, and emissions. Both companies have newer fleets (see Figure 1), which supports both efficiency and sustainability goals.

However, the two companies agreed to terminate their alliance, effective January 2025, citing that “much has changed since they signed the ten-year agreement.” That is no overstatement. A key inflection point was Soren Toft’s move from COO of Maersk to CEO of MSC in December 2020, sending shockwaves through the shipping world. This was the first time in its 50-year history that the Aponte family firm had brought in an outsider to lead MSC. Toft also brought with him a new growth strategy for MSC, one built on acquisitions.

Many predicted that MSC was making a bid to become the biggest shipping company in the world. Sure enough in 2022, news broke that MSC had overtaken Maersk.

MSC’s cruise ship fleet and emissions

MSC’s fleet expansion is in part tied to its successful partnership with Fincantieri, the largest shipbuilder in Europe, including an investment plan to enter the luxury sector. In fact, just earlier this year word leaked that MSC wants to take Royal Caribbean’s “biggest cruise ship title.” MSC cruise ships routinely break size records in port calls, including trips to North America and China, and they are often welcomed given the amount of business they bring.

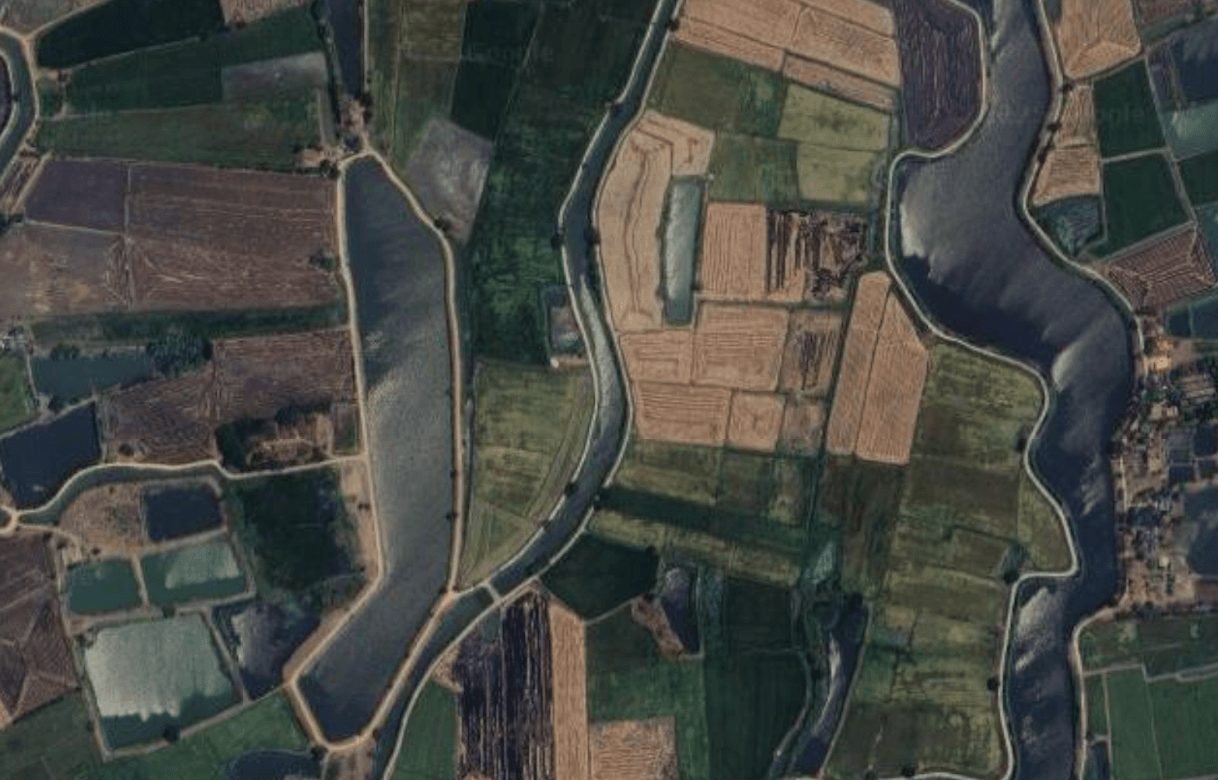

Beyond the cruise ships themselves, MSC has been expanding into real estate, too, with private islands such as Sir Bani Yas in the United Arab Emirates, a wildlife reserve, and Ocean Cay MSC Marine Reserve in the Bahamas. Opened in 2019, Ocean Cay is one of the biggest cruise company island developments, and capacity expansion and enhancement work is currently under way.

On one hand, MSC has invested heavily in ecosystem restoration in places like these islands. In addition, the company’s cruise ships have earned eco accolades such as the Golden Pearls by Bureau Veritas for outstanding standards in environmental protection, health, and safety. Often credited were MSC’s exhaust gas cleaning systems that remove sulphur oxides from exhaust gases and advanced wastewater treatment systems. The MSC WORLD EUROPA earned 12 Golden Pearls and was recognized for its liquefied natural gas (LNG) fuel, high voltage shore connection, and fuel cell demonstrator.

On the other hand, these ships have also contributed to local air pollution impacts and global climate emissions. For example, due to the long distances the 2017 (Fincantieri-built) MSC Seaside travels on ‘ping-pong’ journeys, the ship is notable for producing the most cumulative CO2 emissions of any MSC vessel over the past five years: over 770,000 tonnes of CO2 after travelling more 420,000 nautical miles between January 2018 and June 2023.

Even so, though the size of MSC’s cruise ships have ballooned, their emissions intensity hasn’t — thanks to newer, more-efficient technologies. MSC’s overall passenger vessel emissions intensity is comparable to the global fleet of passenger ships on the whole (see Figure 2).

MSC’s container ship fleet and emissions

Not to be outdone by their cruise ship siblings, MSC’s container ships are also record-breakers. For example, MSC Gülsün was the largest container ship in the world in 2019, capable of carrying up to 23,756 twenty-foot equivalent units (TEU) at a time. That title has since passed to MSC’s Irina Class sister vessels, each with a maximum capacity of 24,346 TEU, per Ship Technologyearlier this year.

MSC fleets produce more CO2 than the Maersk fleet, yet still significantly lower than the global container fleet (see Figure 3). Maersk has been recognised by Ship It Zero as the most progressive carrier in terms of emissions reductions, and the only one of the top 10 global carriers to have a target date of 2040 for decarbonization, while all others have 2050. MSC ranked fifth in the same study, due to reliance on LNG and scrubbers to reach carbon neutrality, and the plan to replace fossil-based LNG with LNG produced from biomass, a strategy that Ship It Zero disagrees with as “it does not believe long-term biofuel is a scalable solution for the maritime sector and still produces problematic emissions.”

MSC’s decarbonization strategy does emphasize LNG and biofuel, including through MSC Biofuel Solution, an internal carbon insetting program whereby MSC purchases biofuel for clients who want to offset emissions and replaces the previously used conventional fossil-based fuel with biofuel within the MSC global network, calculating the CO2 savings and transferring them to the customer. MSC doubled down on its belief in investing in bio-LNG, particularly renewable synthetic LNG, when joining SEA-LNG, a multi-sector industry coalition established to demonstrate the benefits of the LNG pathway as a route to shipping decarbonization. MSC has been one of the early adopters of LNG-fuelled containerships, following the lead of competitor CMA CGM which was the first global carrier to invest significantly in LNG dual-fuelled vessels. But the extreme volatility experienced by the global LNG market in 2022 and 2023 (and likely to continue through 2024) has cast doubts on whether any strategy focusing on LNG will be economically sustainable.

Looking to the future

At the same time as planning for a number of its upcoming passenger ships to use LNG, MSC is also investing in alternative technologies such as testing of hydrogen fuel cells aboard the French-built cruise MSC World Europa and selective catalytic reduction (SCR) systems to reduce the level of nitrogen oxide in the exhaust gas from the engines. MSC has also ordered two vessels from Fincantieri for luxury travel to be delivered in 2027 and 2028, which will be fitted with new generation LNG engines expected to further tackle the issue of methane slip, and will make possible the use of liquid hydrogen with fuel cells for hotel operations to provide sufficient operational power while docked.

On the cargo side, MSC has the industry’s largest newbuilding orderbook of energy-efficient container ships using LNG dual-fuel with a record 134 ships on order, but also has plans that go beyond LNG, including a Memorandum of Understanding (MOU) with Lloyd’s Register, Shanghai Merchant Ship Design & Research Institute, and MAN Energy Solutions to design an ammonia dual-fuel operation of an MSC container ship. Under the MOU, a technical specification and the associated design documents will be developed for a 8,200 TEU container ship design, giving MSC the option to adopt ammonia as a zero-carbon main propulsion fuel for future newbuilding contracts.

Although investing in research in alternative fuels and technologies is sorely needed for shipping to decarbonize, the sheer size of MSC’s orderbook casts questions over whether the efficiency of the new ships will be balanced out by their number, leaving MSC no better off in terms of overall absolute emissions (see Figure 4).

In 2023, MSC signed a five-year agreement with the Global Centre for Maritime Decarbonization (GCMD), the third container line to do so, in which MSC will contribute funds to GCMD's pilots and trials of lower-emissions fuels and provide access to vessels, operational equipment, operating data, and evaluation reports. MSC is also an active partner and member of the Methane Abatement in Maritime Innovation Initiative and the Society for Gas as a Marine Fuel — collaborations that reinforce Toft’s plan for MSC to lower emissions by relying on a mix of zero-carbon fuels and a range of alternative fuel options. Part of the strategy is to strengthen an interconnected network of bunkering infrastructure and push for decarbonized shipping trade routes, also known as green corridors.

In December 2023 at the UN’s COP 28 climate conference, in an unprecedented action, the CEOs of Maersk, CMA CGM, Hapag-Lloyd, Wallenius Wilhelmsen, and MSC issued a joint declaration expressing shared conviction that regulation can play a key role in accelerating the transition to green fuels and urging the International Maritime Organization to establish four regulatory cornerstones:

1.An end date for new building of fossil fuel-only vessels and a clear GHG Intensity Standard timeline.

-

An effective GHG pricing mechanism to make green fuel competitive against black fuel during the transition phase when both are used.

-

A vessel pooling option for GHG regulatory compliance where the performance of a group of vessels could count instead of only that of individual ships.

-

A ‘Well-to-Wake’ or lifecycle GHG regulatory basis to align investment decisions with climate interests and mitigate the risk of stranded assets.

But while MSC is picturing the green transition happening alongside its path of expansion, others in the container shipping industry are bracing for tough times ahead, with Hapag-Lloyd’s CEO predicting the tail end of a container boom, brought on partly by port congestion when business soared after the COVID-19 lockdown, and Maersk’s CEO foreseeing disruption related to an energy crisis in Europe and economic uncertainty. The inflation seen in the carrier industry has also been driven by the record new-building capacity entering the market, topped by MSC. Within this economic context, many have wondered in amazement, if not alarm, at what MSC could possibly see as a reason to expand that others do not.

Regardless of where the shipping industry winds may blow, MSC’s ‘Monopoly game style’ growing portfolio of cargo shipping companies, cruise ships, ferry companies, port terminals, maritime and travel agencies, tour operators, technology and cybersecurity centers, and logistics companies, has certainly put the company on the map as a force to be reckoned with.

What remains to be seen is how MSC will combine its insatiable appetite for growth with its commitment to sustainability, especially with the amount of newbuild ships being commissioned, and whether the true world emissions reduction impact will match the company’s decarbonization ambitions and targets. Climate TRACE is a tool that can provide the answers through transparency at the global and asset level.

Stella Bartolini Cavicchi is marine policy adviser at OceanMind.

image credits**photographs of MSC container and cruise ships via iStock (olrat), iStock (Bjoern Wylezich), and iStock (eyewave). Sir Bani Yas, Ocean Cay MSC Marine Reserve, and MSC Seaside satellite imagery via OceanMind. All charts / data visualizations via OceanMind / Climate TRACE.