Climate Risk Services’ Gerhard Mulder on financed emissions and the ‘holy grail’ of emissions data

In this ongoing Climate TRACE series, we interview individual coalition members, contributors, and collaborators about their work. We recently talked with Gerhard Mulder, co-founder and CEO of Climate Risk Services, about using Climate TRACE asset-level data to assess financed emissions and green finance decarbonization opportunities. Mulder was also a panelist in the September 2025 Climate TRACE webinar "From Financed Emissions to Financing Emissions Reductions."

In this ongoing Climate TRACE series, we interview individual coalition members, contributors, and collaborators about their work. We recently talked with Gerhard Mulder, co-founder and CEO of Climate Risk Services, about using Climate TRACE asset-level data to assess financed emissions and green finance decarbonization opportunities. Mulder was also a panelist in the September 2025 Climate TRACE webinar "From Financed Emissions to Financing Emissions Reductions."

Could you start by setting the scene and telling us about Climate Risk Services? What's your core mission?

At our core, we help organizations understand and act on climate risk --- both physical and financed. Understanding a bank's financed emissions, in other words, how much they are lending to carbon intensive companies, is key to understanding transition risk.

Most of our clients are financial institutions, because the financial sector is a key place to start if you want to affect change. After all, banks and investors decide what gets funded and what doesn't. That's one of the reasons regulators like the European Commission focus on banks and central banks. They see the sector as a powerful lever to influence broader economic activity.

We also work with non-financial companies in areas like mining, agriculture, and energy. Our goal for every organization we work with is to provide clear, usable insight into climate impacts that affect their business. In practice, this work has two main strands:

First, we develop data tools that are simple but robust, so decision-makers can use them even if they aren't technical experts. Whether it's assessing portfolio risks or evaluating companies, the data needs to be intuitive and reliable.

The second part is advisory: we sit down with organizations, understand their challenges, and help them integrate climate considerations into areas like credit risk, strategy, or governance. We try to put ourselves into the shoes of our users as we design processes, creating useful dashboards and providing training that will stick.

What kinds of risks does your platform help financial institutions understand? How do you help them address those risks?

Banks operate in a volatile, unpredictable world. A big part of our work is helping them understand the climate risks in their portfolios. To build resilience in this new world, banks need to map risks, explore plausible but severe scenarios, and generate strategic options for different ways forward.

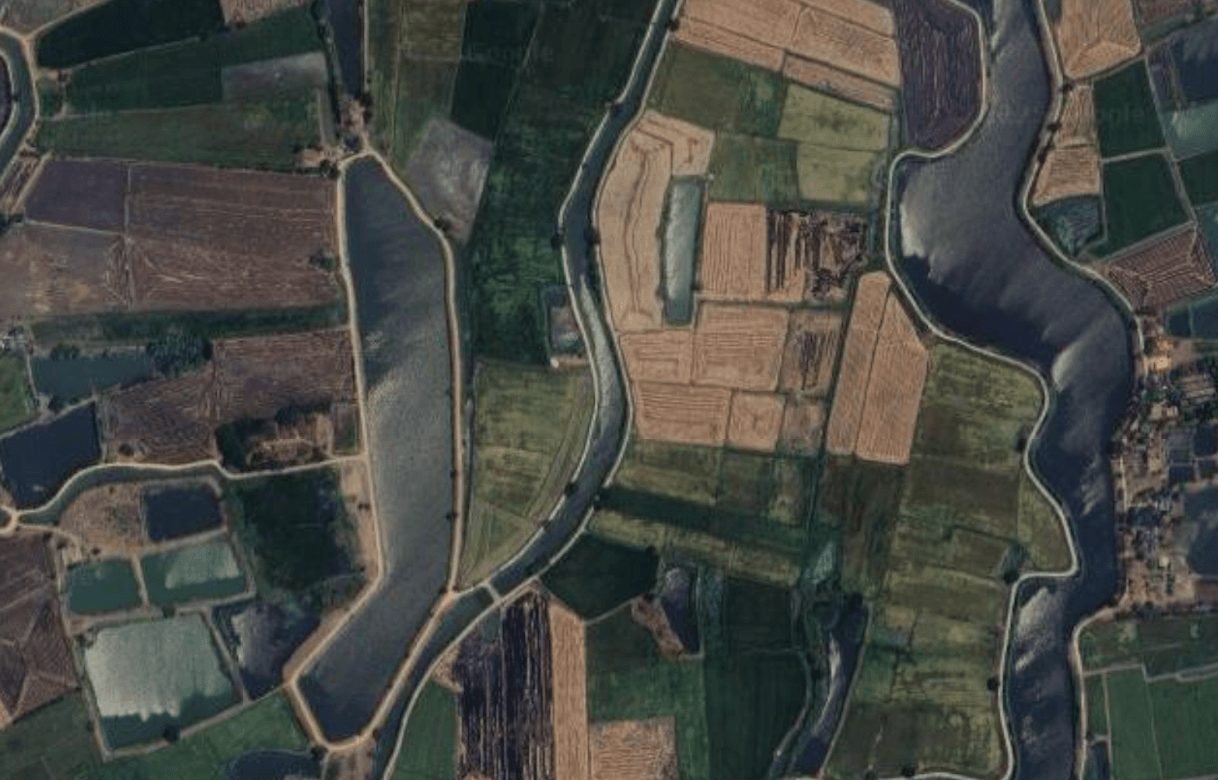

Let's say you are a bank in Latin America. There's a good chance you're heavily exposed to agriculture, which is very sensitive to all kinds of physical climate hazards --- droughts, water stress, extreme precipitation, for example. Banks need a clear view into all of that, so our platform provides insights on the probability and severity of each hazard happening, helping them see which parts of their portfolio are most vulnerable. It also accounts for differences across sectors --- for instance, a wind farm is very sensitive to wind speed but not to flooding.

Our platform covers 14 hazards and 100 sectors, in countries all around the world, using methodologies aligned with IPCC and ISO standards, as well as best practices from central banks. Once a bank uploads its portfolio, the platform identifies which sectors are most exposed, which geographies drive risk, and where concentrations of climate risk are highest.

Another major source of risk we now address is financed emissions --- the greenhouse gas emissions associated with the bank's own operational impact as well as its financing strategies. The more carbon-intensive a portfolio is, the more exposed it is to things like carbon pricing. If the government steps in and says we're going to charge all the companies in your portfolio, say, $50 per ton of CO2, then that can be a huge hit on the profitability of the company --- and potentially its ability to repay loans. So you need to have transparency around your financed emissions.

Why has it been difficult for institutions to get good data on climate-related risks?

There's no mathematical model that can capture all these risks in a simple metric. Big providers like S&P, Moody's, or Jupiter Intelligence do good work in this space, but their focus tends to be on developed economies. Emerging markets, which are the places most affected by climate change, have largely been underserved.

That's where we come in. We work closely with banks in those emerging markets. Some of the larger banks can afford subscriptions to major data providers, but many cannot. We designed our platform specifically with emerging market banks in mind: to give them access to actionable, reliable climate risk data.

It's traditionally been extremely difficult to get emissions data on target investments or to understand investment risk in owned assets, particularly for banks in emerging markets. The holy grail of financed emissions is asset-level data, which was either very expensive or poor quality --- until Climate TRACE entered the picture.

What drew you to Climate TRACE? How do Climate TRACE data support your work?

Climate TRACE is a public good unlike anything I've seen in this space. Bringing in all these different partners and technologies, the coalition creates radical transparency with comprehensive, publicly available data. Life doesn't get much better than that.

So at Climate Risk Services, we use Climate TRACE's asset-level data to assess carbon exposure across portfolios, translating those emissions into financed dollars with our Financed Emissions Tool. The tool provides a clear picture of carbon exposure in financial terms, giving banks in emerging markets clear visibility into their financed emissions, including Scope 2 and Scope 3, so they can act even in markets where companies don't self-report.

For example, we recently helped a leading bank in Egypt evaluate financed emissions on its loan book. Using Climate TRACE data and our Financed Emissions Tool, we were able to estimate financed emissions for 80%+ of the Egyptian bank's corporate loan book. This improved the bank's ability to prioritize green lending opportunities and better assess climate-related risks.

[Editor's note: A detailed case study of how CRS used Climate TRACE data to build its Financed Emissions Tool and support a major Egyptian bank is available for free download here.]

How do you help banks turn data into actionable insight?

We take all the information and make it decision-useful for the people who need to act --- in the markets where it will have the most impact. Essentially our role is as the synthesizer: We slice and dice the data and turn it into something intuitive for the average banker in an emerging market.

Because once banks can see clearly where risks are concentrated --- whether from climate hazards or financed emissions --- they can make more strategic choices. They can decide which markets to enter, which products to develop, and how to price risk. Scenario analysis is central to that process: it lets banks explore possible outcomes and see which strategies hold up.

At the end of the day, we want banks to look at climate risk as an opportunity to act proactively, not reactively. We know they're under pressure to disclose their efforts to transition to a low-carbon economy. They're also under pressure from central banks to provide disclosures of climate risks that could weaken the financial system. And then there's societal and legal pressure for greater transparency.

But when they know their baseline financed emissions, they can set real-world reduction goals --- and in turn identify ways to achieve those goals and contribute to a net-zero, climate-resilient future.

Looking ahead, what gives you hope about the impact of this work?

What gives me hope is the power of transparency. Philosophically, we are very aligned with Climate TRACE in a shared mission to create impact at scale and achieve the highest possible impact. If we keep making data-driven insights actionable, we're going to see banks driving change in ways that were impossible just a few years ago.

Interviewed by Daisy Simmons. This interview has been edited for length and clarity.